How do companies cooking their book in order to see a “soaring reported earnings”? There are hundred ways of doing it, among other are:

How do companies cooking their book in order to see a “soaring reported earnings”? There are hundred ways of doing it, among other are:1) Acquiring other companies in an effort to boost their balance sheet. Whether the acquired companies will bring synergistic effort to the company or not and offered price is not the concern of the management. After all, the acquired money is taken out from the shareholders’ pocket, not theirs.

2) Paying lawyers and bankers for their services as “financial engineers”. While the role of the lawyers is to protect the interest of the company for the legal part, acting as a “financial engineers” sound strength.

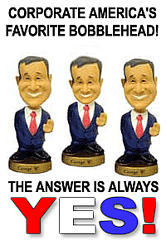

3) Awarding themselves stock option by the corporate manager and buying back outstanding shares in the market, in order to offset the dilution of earnings per share (EPS) created by the options. The pricing of the share buy back is not the issue. Once again, the money is still comes out from the shareholders’ pocket, not theirs. The management would not lose out the game since it is an “option”, that means they have the right to exercise the right to buy the option awarded to them. If the market price of the stock is below their exercise price, they can just forget about the option and still enjoying the benefits, such as huge bonus and incentives. If the stock’s market price is above their exercise price, they got the premium. Do not forget that, there is also hundred ways to boost up the market price by the interested parties.

No comments:

Post a Comment