skip to main |

skip to sidebar

"We prefer better profits to better cosmetics.

Over the years, a number of very smart people have learned the hard way that a long string of impressive numbers multiplied by a single zero always equals zero. That is not an equation whose effects I would like to experience personally, and I would like even less to be responsible for imposing its penalties upon others." -- Warren Buffett, Letter To Shareholders, Berkshire Hathaway Inc., 2005.

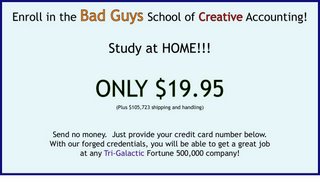

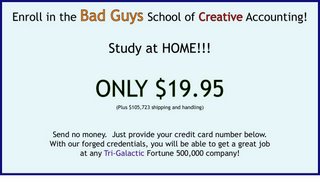

How do companies cooking their book in order to see a “soaring reported earnings”? There are hundred ways of doing it, among other are:

How do companies cooking their book in order to see a “soaring reported earnings”? There are hundred ways of doing it, among other are:

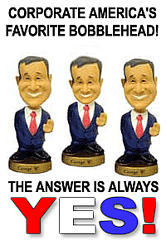

1) Acquiring other companies in an effort to boost their balance sheet. Whether the acquired companies will bring synergistic effort to the company or not and offered price is not the concern of the management. After all, the acquired money is taken out from the shareholders’ pocket, not theirs.

2) Paying lawyers and bankers for their services as “financial engineers”. While the role of the lawyers is to protect the interest of the company for the legal part, acting as a “financial engineers” sound strength.

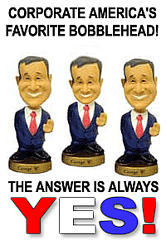

3) Awarding themselves stock option by the corporate manager and buying back outstanding shares in the market, in order to offset the dilution of earnings per share (EPS) created by the options. The pricing of the share buy back is not the issue. Once again, the money is still comes out from the shareholders’ pocket, not theirs. The management would not lose out the game since it is an “option”, that means they have the right to exercise the right to buy the option awarded to them. If the market price of the stock is below their exercise price, they can just forget about the option and still enjoying the benefits, such as huge bonus and incentives. If the stock’s market price is above their exercise price, they got the premium. Do not forget that, there is also hundred ways to boost up the market price by the interested parties.

“An account without accountability is just a number games, in which it serves other than none, entertainment purpose for you.”Often, individual investors fall into the prey of their predators in Wall Street. While the parties who manage the company account with “Creative Accounting” should be blamed for the fraud, the investors should not be left from the responsibility for the fraud. In the world of hoping for short term quick profit from the stock market, there is only one way to fulfill the hope: by cooking the book. Thus, the parties found hundred ways to inflate the reported earnings of the company to fulfill the consensus estimate and thus jerking up the stock price. The manipulated price would not long last. Sooner or later, the factor that determines the price of the stock lays no other places but in its ability to create a value to the society. People tend to forget about this reality and hope for unrealistic continuous earnings growth.

“An account without accountability is just a number games, in which it serves other than none, entertainment purpose for you.”Often, individual investors fall into the prey of their predators in Wall Street. While the parties who manage the company account with “Creative Accounting” should be blamed for the fraud, the investors should not be left from the responsibility for the fraud. In the world of hoping for short term quick profit from the stock market, there is only one way to fulfill the hope: by cooking the book. Thus, the parties found hundred ways to inflate the reported earnings of the company to fulfill the consensus estimate and thus jerking up the stock price. The manipulated price would not long last. Sooner or later, the factor that determines the price of the stock lays no other places but in its ability to create a value to the society. People tend to forget about this reality and hope for unrealistic continuous earnings growth.

In nature, there is a cycle: the day would be last with night; the last of winter would be followed by spring. So, in business. Businesses rise and fall, only businesses that create values could last longer than ordinary businesses. The success of the businesses would not bear fruit in quarters, but in years. Hoping for quick result would only bring disappointment to the investors and the hope is just merely a utopian hope, the hope that does not exist in the reality.