“Develop your employees. Promotion from within is important.”

“Develop your employees. Promotion from within is important.”

Saturday, September 30, 2006

Thursday, September 28, 2006

The Warren Buffett CEO 12: Rich Santulli III

Perhaps unconsciously following Andrew Carnegie’s dictate that “He who dies rich, dies disgraced,” Santulli says, “Everything that I have will be given away while I am alive, minus enough for my wife to live.”

Note: Rich Santulli set up a family foundation, RTS Family Foundation where he spends his time in charity works.

Wednesday, September 27, 2006

The Warren Buffett CEO 11: Rich Santulli II

“My circle of competence is that I understand business very well. I understand people very well. I understand the aviation business. I don’t know how to make an airplane and I don’t know how to fly an airplane, but I know what customers—people—like in airplanes. I know that. And I know how to take that and turn it into something that works from an economic point of view.”

“Hire the best people and don’t be afraid they’re going to take over your job. After they show their abilities, empower them and delegate. You have to look long term, and hiring the best employee is one way to ensure your future success.”

Labels:

CEO,

NetJets,

Rich Santulli,

Warren Buffett

Tuesday, September 26, 2006

The Warren Buffett CEO 10: Rich Santulli I

“Because people who buy companies usually have huge egos and think they’re smarter than the people they bought the company from, One of the nicest things about being part of Berkshire is that if I said to Warren, ‘I am going to go buy $1 billion worth of airplanes,’ he would say, ‘Why are you asking me? Go do it.’”

“Because people who buy companies usually have huge egos and think they’re smarter than the people they bought the company from, One of the nicest things about being part of Berkshire is that if I said to Warren, ‘I am going to go buy $1 billion worth of airplanes,’ he would say, ‘Why are you asking me? Go do it.’” “You have to love your business. You have to care about your people. You have to treat them with dignity and respect. And you have to communicate well with your people to let them know what is going on.”

Labels:

Berkshire Hathaway,

CEO,

NetJets,

Rich Santulli,

Warren Buffett

Monday, September 25, 2006

The Warren Buffett CEO 9: Interview with an author, Robert P. Miles III

“Charlie Munger was right when he said that the top 25 managers at Berkshire could all die at once and Berkshire would continue successfully. Berkshire by its very culture and structure is deeper than any other conglomerate because it doesn't exist with just one CEO. Berkshire is a holding company of CEOs all operating independently of one another. Unlike every other traditional corporation, none of the CEOs has a term limit. All the Buffett CEOs have designated a successor.”

“Charlie Munger was right when he said that the top 25 managers at Berkshire could all die at once and Berkshire would continue successfully. Berkshire by its very culture and structure is deeper than any other conglomerate because it doesn't exist with just one CEO. Berkshire is a holding company of CEOs all operating independently of one another. Unlike every other traditional corporation, none of the CEOs has a term limit. All the Buffett CEOs have designated a successor.”

Labels:

Berkshire Hathaway,

CEO,

Charlie Munger,

Robert P. Miles,

Warren Buffett

Saturday, September 23, 2006

The Warren Buffett CEO 8: Interview with an author, Robert P. Miles II

“Since Warren Buffett has never lost a CEO to another competing enterprise, all the managers reported complete satisfaction with their deal and ongoing relationship.”

“Since Warren Buffett has never lost a CEO to another competing enterprise, all the managers reported complete satisfaction with their deal and ongoing relationship.” “Warren asked that no interview transcripts be sent to him because he didn't want to influence the book in any way. No one asked for manuscript approval and no one asked for any changes in the book.”

Labels:

Berkshire Hathaway,

CEO,

Robert P. Miles,

Warren Buffett

Friday, September 22, 2006

The Warren Buffett CEO 7: Interview with an author, Robert P. Miles I

Excerpts from an interview with Robert P. Miles:

“It's totally up to each manager. Few meet with him in person. Most phone every few weeks if they need advice or want to report in. After the purchase of See's Candies, it was over 20 years before its CEO, Chuck Huggins, even visited Omaha.”

“….Bill Child of R.C. Willey Home Furnishings took a call from a dissatisfied customer right in the middle of our interview. He also lists his home phone on his business card. The Tatelman brothers of Jordan Furniture treat their employees like they are the customers. Executive Jet CEO Rich Santulli keeps his small corporate office near New York City while most of his employees and his operational center are in Columbus.”

Thursday, September 21, 2006

The Warren Buffett CEO 6: Al Ueltschi

“Before we became part of Berkshire, when we were on the New York Stock Exchange, I was constantly questioned about how much money we were going to make the next quarter and why we didn’t make more the last quarter. Now we run the company for the long term without worrying about the next quarter. That’s one of the best things about working with Warren.”

“Before we became part of Berkshire, when we were on the New York Stock Exchange, I was constantly questioned about how much money we were going to make the next quarter and why we didn’t make more the last quarter. Now we run the company for the long term without worrying about the next quarter. That’s one of the best things about working with Warren.” “Leadership is really what being a good manager is about, and the letters of the word represent the qualities that a good manager should have:

L – Loyalty

E – Enthusiasm

A – Attitude

D – Discipline

E – Example, a good Example

R – Respect

S – Scholarliness

H – Honesty

I – Integrity

P – Pride”

“Aim to be the leader in your field. Strive to be the benchmark against which your competitors measure their progress.”

Note: Ueltschi (pronounced Yule - chee)

Labels:

Al Ueltschi,

CEO,

FlightSafety International,

NYSE,

Warren Buffett

Tuesday, September 19, 2006

Monday, September 18, 2006

The Warren Buffett CEO 4: Ajit Jain

“When you take risks, you have to accept that you have some losses. You can’t let this keep you at night. When we make a deal, we stick to it.”

“Avoid dumb mistake—do everything possible to anticipate the risks in a deal. The worst thing is when something you hadn’t even considered comes back to haunt you.”

“A good manager must quickly make a decision and move on. If you’re on the fence about a particular deal, then you probably should decline and move on to the next opportunity.”

Labels:

Ajit Jain,

CEO,

National Indemnity Company,

Warren Buffett

Sunday, September 17, 2006

The Warren Buffett CEO 3: Lou Simpson

5 basic principles for stock portfolio:

5 basic principles for stock portfolio:1) Think independently. “We try to be skeptical of conventional wisdom, and try to avoid the waves of irrational behavior and emotion that periodically engulf Wall Street.”

2) Invest in high-return businesses that are run for the shareholders. “Cash flow, which is more difficult to manipulate than reported earnings, is a useful additional yardstick.”

3) Pay only a reasonable price, even for an excellent business. “Even the world’s greatest business is not a good investment, if the price is too high.”

4) Invest for the long term. “Moving in and out of stocks frequently has two major disadvantages that will substantially diminish results: transaction costs and taxes. Capital will grow more rapidly if earnings compound with as few interruptions for commissions and tax bites as possible.”

5) Do not diversify excessively. “The more diversification, the more performance is likely to be average, at best.”

Saturday, September 16, 2006

The Warren Buffett CEO 2: Tony Nicely

“We don’t want only to be the fairest organization that we could possibly be; we also want to be perceived as the fairest organization possible. I think that’s an even higher standard.”

“We don’t want only to be the fairest organization that we could possibly be; we also want to be perceived as the fairest organization possible. I think that’s an even higher standard.” “Honesty and integrity have to be set at the top of the list. But it not only has to be there, there has to be a perception that it’s there.”

Friday, September 15, 2006

The Warren Buffett CEO 1

Thursday, September 14, 2006

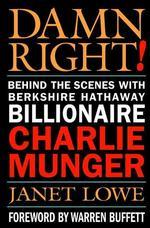

Charlie Munger in Damn Right! 9

“It’s….necessary to accommodate a lot of failure, and because no matter how able you are, you’re going to have headwinds and troubles. The Sees who created this business had failed at least once, and had seriously failed. But if person just keeps going on the theory that the life is full of vicissitudes and just does the right thinking and follows the right values it should work out well in the end. So I would say, don’t be discouraged by a few reverses”

“One of Bernard Shaw’s characters explained professional defects as follow: ‘In the last analysis, every profession is a conspiracy against the laity.’”

“To a man with only a hammer, every problem tends to look pretty much like a nail.”

“One of Bernard Shaw’s characters explained professional defects as follow: ‘In the last analysis, every profession is a conspiracy against the laity.’”

“To a man with only a hammer, every problem tends to look pretty much like a nail.”

Wednesday, September 13, 2006

Charlie Munger in Damn Right! 8

“First rate man should be willing to take at least some difficult jobs with a high chance of failure.”

“I’ve been in one aspect or another of investment management for what. 44 years or so, and trying not to disappoint anyone,” said Buffett. “And in the process of not disappointing anyone, one of the key factors is having them have the proper expectations and being knowledgeable about what they’re getting and what they’re not getting. Neither Mr. Munger nor I would function as effectively if we had tens of thousands of people who were in one way or another disappointed with us. That’s not Berkshire.”

“I’ve been in one aspect or another of investment management for what. 44 years or so, and trying not to disappoint anyone,” said Buffett. “And in the process of not disappointing anyone, one of the key factors is having them have the proper expectations and being knowledgeable about what they’re getting and what they’re not getting. Neither Mr. Munger nor I would function as effectively if we had tens of thousands of people who were in one way or another disappointed with us. That’s not Berkshire.”

Tuesday, September 12, 2006

Charlie Munger in Damn Right! 7

“You want in a group of people someone who points out that the emperor has no clothes.”

“Smart, hard-working people aren’t exempted from professional disasters of overconfidence. Often, they just go aground in the more difficult voyages they choose, relying on their self-appraisal that they have superior talents and methods.”

“Smart, hard-working people aren’t exempted from professional disasters of overconfidence. Often, they just go aground in the more difficult voyages they choose, relying on their self-appraisal that they have superior talents and methods.”

Labels:

Charlie Munger,

Damn Right,

Jordan's Furniture

Monday, September 11, 2006

Charlie Munger in Damn Right! 6

“Charlie says as you get older you tolerate more and more in your old friends and less and less in your new friends.” – Warren Buffett

“Charlie says as you get older you tolerate more and more in your old friends and less and less in your new friends.” – Warren Buffett Warren Buffett scolded investment bankers for providing whatever advice would bring them the most income: “Don’t ask you barber whether you need a haircut,” he wrote in Berkshire’s 1982 annual report.

Sunday, September 10, 2006

Charlie Munger in Damn Right! 5

“The game of investing is one of making better predictions about the future than other people. How are you going to do that? One way is to limit your tries to areas of competence. If you try to predict the future of everything, you attempt too much. You’re going to fail through lack of specialization.”

“We’re willing to forego short-term results for long-term gains.”

Labels:

Charlie Munger,

Damn Right,

Nebraska Furniture Mart,

NFM

Saturday, September 09, 2006

Charlie Munger in Damn Right! 4

“We have gotten by trying to be consistently not stupid, instead of trying to be very intelligent. There must be some wisdom in the folk saying, ‘It’s the strong swimmers who drown.’”

“You start with the accounting figures. But that’s only the start. If you try and make judgments just based on accounting figures, you will make one terrible error after another. We’ve got to understand the accounting and the implications of the accounting and understand it thoroughly and also ask a lot of intelligent questions to enable us to judge what is really going on.”

Friday, September 08, 2006

Charlie Munger in Damn Right! 3

“If you mix raisins with turds, they are still turds.”

“Being prepared, on a few occasions in a lifetime, to act promptly in scale, in doing some simple and logical things, will often dramatically improve the financial results of the lifetime. A few major opportunities clearly recognizable as such, will usually come to one who continuously searches and waits, with a curious mind, loving diagnosis involving multiple variables. And then all that required is a willingness to bet heavily when the odds are extremely favorable, using resources available as a result of prudence and patience in the past.”

Labels:

Charlie Munger,

Coca-cola,

Coke,

Damn Right

Thursday, September 07, 2006

Charlie Munger in Damn Right! 2

“The best way to avoid envy is to deserve the success you get.”

“The best way to avoid envy is to deserve the success you get.” “The investment game always involves considering both quality and price, and the trick is to get more quality than you pay for the price. It’s just that simple.”

“Never wrestle with a pig because if you do you’ll both get dirty, but the pig will enjoy it.”

Wednesday, September 06, 2006

Charlie Munger in Damn Right! 1

“To finish first you have to first finish.”

“The rabbit runs faster than the fox, because the rabbit is running for his life while the fox is only running for his dinner.” – Richard Dawkins, “The Selfish Gene”

“You have to learn to be a follower before you become a leader. People should learn to play all roles.”

Labels:

Charlie Munger,

Coca-cola,

Coke,

Damn Right,

Richard Dawkins,

The Selfish Gene

Tuesday, September 05, 2006

Peter Lynch on Beating the Street 12

“Sell a stock because the company’s fundamentals deteriorating, not because the sky is falling.”

“Nobody can predict interest rates, the future direction of the economy, or the stock market. Dismiss all such forecasts and concentrate on what’s actually happening to the companies in which you’ve invested.”

“If you don’t study any companies, you have the same success buying stocks as you do in a poker game if you bet without looking at your cards.”

Monday, September 04, 2006

Peter Lynch on Beating the Street 11

“Behind every stock is a company. Find out what it’s doing.”

“Behind every stock is a company. Find out what it’s doing.”“Owning stocks is like having children—don’t get involved with more than you can handle.”

“Never invest in a company without understanding its finances.”

“Everyone has the brainpower to make money in stocks. Not everyone has the stomach. If you are susceptible to selling everything in a panic, you ought to avoid stocks and stock mutual funds altogether.”

Sunday, September 03, 2006

Peter Lynch on Beating the Street 10

“Investing is fun, exciting, and dangerous if you don’t do any work.”

“Your investor’s edge is not something you get from Wall Street experts. It’s something you already have. You can outperform the experts if you use your edge by investing in companies or industries you already understand.”

“Over the past three decades, the stock market has come to be dominated by a herd of professional investors. Contrary to popular belief, this makes it easier for the amateur investor. You can beat the market by ignoring the herd.”

Saturday, September 02, 2006

Peter Lynch on Beating the Street 9

“Corporations, like people, change their names for one of two reasons: either they’ve gotten married, or they’ve been involved in some fiasco that they hope the public will forget.”

“During periods when mutual funds are popular, investing in the companies that sell the funds is likely to be more rewarding than investing in their products. I’m reminded that in the Gold Rush the people who sold picks and shovels did better than the prospectors.”

“As the price of the stock rose, the Wall Street analysts increased their earnings estimates for the company. This is an example of tailoring the means to fit the ends.”

Friday, September 01, 2006

Peter Lynch on Beating the Street 8

“A sneaky method by which unscrupulous banks and S&L camouflage their problem loans. If a developer, say, asks to borrow $1 million for a commercial project, the bank offers him $1.2 million on the basis of an inflated appraisal. The extra $ 200,000 is held in reserve by the bank. If the developer defaults on the loan, the bank can use this extra money to cover the developer’s payments. That way, what has turned into a bad loan can still carried on the books as a good loan—at least temporarily……. If it’s right, it’s another reason to avoid investing in banks and S&Ls with large portfolios of commercial real estate.”

“Corporate managers often pay lip service to “enhancing shareholder value” and then go out and squander the money on fanciful acquisitions, ignoring the simplest and most direct way to reward shareholders—buying back shares.”

Subscribe to:

Posts (Atom)