skip to main |

skip to sidebar

“The best stock to buy may be the one you already own.”

“The best stock to buy may be the one you already own.”

“There’s no shame in losing money on a stock. Everybody does it. What is shameful is to hold on to a stock, or, worse, to buy more of it, when the fundamentals are deteriorating.”

“Stockpicking is both an art and science, but too much of either is a dangerous thing. A person infatuated with measurement, who has his head stuck in the sand of the balance sheets, is not likely to succeed. If you could tell the future from a balance sheet, then mathematicians and accountants would be the richest people in the world by now.”

“The newspaper had made a big deal of this “worst one-day drop since 1929,” even though the comparison was absurd. A 36-point drop with the Dow at 990 was not the same thing as a 36-point drop with the Dow at 280, which is where it stood before the Crash.”

“The newspaper had made a big deal of this “worst one-day drop since 1929,” even though the comparison was absurd. A 36-point drop with the Dow at 990 was not the same thing as a 36-point drop with the Dow at 280, which is where it stood before the Crash.”

“In stocks as in romance, ease of divorce is not a sound basis for commitment. If you’ve chosen wisely to begin with, you won’t want a divorce. And if you haven’t, you are in a mess no matter what. All the liquidity in the world isn’t going to save you from pain, suffering, and probably a loss of money.”

“The extravagance of any corporate office is directly proportional to management’s reluctance to reward the shareholders.”

“The extravagance of any corporate office is directly proportional to management’s reluctance to reward the shareholders.”

“Pulling out the flowers and watering the weeds.”

“This is one of the keys to successful investing: focus on the companies, not on the stocks.”

“Japanese investors, we hear, paid little heed to earnings and focused their attention to cash flow – perhaps due to shortage of the former. Companies spend money like drunken sailors, especially on acquisitions and real estate, are left with a huge depreciation allowance and a lot of debts to pay off, which gives them a high cash flow/low earnings profile.”

“Japanese banks were making 100% loans on zero collateral for office buildings where in the most optimistic scenario the rents would barely cover the expenses.”

“It isn’t the head but the stomach that determines the fate of the stockpicker.”

“It isn’t the head but the stomach that determines the fate of the stockpicker.”

“Good information is useless without the willpower. In dieting and in stocks, it is the gut and not the head that determine the results.”

“Keeping the faith and stockpicking are normally not discussed in the same paragraph, but success in the latter depends on the former. You can be the world’s greatest expert on balance sheet or p/e ratios, but without faith, you’ll tend to believe the negative headlines.”

“Just because a stock goes down doesn’t mean it can’t go lower.”

“Just because a stock goes down doesn’t mean it can’t go lower.”

“You should not buy a stock because it’s cheap but because you know a lot about it.”

“There’s a Tolstoy story that involves an ambitious farmer. A genie of some sort offers him all the land that he can encircle on foot in a day. After running at full speed for several hours, he acquires several square miles of valuable property, more soil than he could till in a lifetime, more enough to make him and his family rich for generations. The poor fellow is drenched with sweat and gasping for breath. He thinks about stopping—for what’s the point of going any further?—but he can’t help himself. He races ahead to maximize his opportunity, until finally he drops dead of exhaustion. This was the ending I hoped to avoid.”

“There’s a Tolstoy story that involves an ambitious farmer. A genie of some sort offers him all the land that he can encircle on foot in a day. After running at full speed for several hours, he acquires several square miles of valuable property, more soil than he could till in a lifetime, more enough to make him and his family rich for generations. The poor fellow is drenched with sweat and gasping for breath. He thinks about stopping—for what’s the point of going any further?—but he can’t help himself. He races ahead to maximize his opportunity, until finally he drops dead of exhaustion. This was the ending I hoped to avoid.”

People often say: “Low risk, low return; high risk, high return.” Is it a truth? Let’s us examine it through an example of the investments made shown below.

People often say: “Low risk, low return; high risk, high return.” Is it a truth? Let’s us examine it through an example of the investments made shown below.

Fund CAT is the best performer in Malaysian Unit Trust (Mutual Fund) industry for the period of more than 5 years as per 23rd June 2006. In the stable of around 400 funds to choose from, whether it is equity fund, bond fund, mixed fund, money market fund and so forth, it is the fund that gives the best return to its unit holders.

Fund CAT performance from 25th June 2001 to 23rd June 2006 is 113.04% which translated into 16.33% Compounded Annual Growth Rate (CAGR). One should notice that 2001/02 was the most bargain market since 1999. When count from an inception date of Fund CAT, which is in 1999, the fund performance is 90.5%, which translated into 9.67% CAGR.

How about placing all investment in a single stock? Is it really a high risk investment? Take an example of RLQ. RLQ is a resource-based company and its core activities are in 3 categories, namely Marine Products Manufacturing (MPM), Crude Palm Oil Milling (CPOM) and Integrated Livestock Farming.  In the same period, RLQ generates a return of 119.27%, which is 17% CAGR. Bear in mind that RLQ is not the best performer of the market. Furthermore, since RLQ main businesses are in resource-based industry, any negative happenings would have impact to its performance. In the period mentioned, RLQ experienced few incidences such as high price of raw materials such as soy bean meal and corn meal, 2 bird flu threats and tsunami which have a huge negative impact to its underlying businesses. Nevertheless, it gives a better performance compared to Fund CAT which adapts a diversification policy.

In the same period, RLQ generates a return of 119.27%, which is 17% CAGR. Bear in mind that RLQ is not the best performer of the market. Furthermore, since RLQ main businesses are in resource-based industry, any negative happenings would have impact to its performance. In the period mentioned, RLQ experienced few incidences such as high price of raw materials such as soy bean meal and corn meal, 2 bird flu threats and tsunami which have a huge negative impact to its underlying businesses. Nevertheless, it gives a better performance compared to Fund CAT which adapts a diversification policy.

While at a glance, Fund CAT is a more low risk investment made since its investments are well diversified into various sectors, money market and cash. At the same time, investment made on RLQ seems pose a high risk to its investors since RLQ businesses are in resource based industry, meaning that any negative happenings in the industry would cause negative impact to RLQ bottom line and ultimately to its investors. Nevertheless, anyone who chooses either Fund CAT or RLQ as his investment would reap similar return to his nest egg. One should always remember that investment made through rear mirror would not guarantee his investment success. When an investment result is most of the time relied on capability of the investment manager, it is worthwhile to aware any changes in fund’s investment team members. They are the one who decide the investment result of yours.

Note: As we are investors with long term perspective, any investment with less than 5 years is meaningless. Thus, we only use investments with minimum 5 years period for comparison. Remember, investment is a marathon, not a 100 meter race.

Michelangelo, who often called as “Il Divino” (The Divine One) in his life time designed and became a chief architect the dome (cupola) of Saint Peter’s Basilica, Vatican City, Rome in 1546. After his death, the work continued by Giacomo della Porta with the assistance of Domenico Fontana.

Michelangelo, who often called as “Il Divino” (The Divine One) in his life time designed and became a chief architect the dome (cupola) of Saint Peter’s Basilica, Vatican City, Rome in 1546. After his death, the work continued by Giacomo della Porta with the assistance of Domenico Fontana.

The dome has a diameter of 42 meter and it is the largest dome in the world. It is reaching 138 meter high. The site is the buried site of Saint Peter, one of the apostle of Jesus Christ in 64 A.D.

Excerpts from: http://www.theedgedaily.com/

“The Malaysian equity funds have posted "respectable returns" over the mid- to long-term periods, the Federation of Malaysian Unit Trust Managers (FMUTM). It said based on Standard & Poor's report on the fund performance as at July 28, 2006, the average returns for Malaysian equity funds for the seven-year period was 24%, five-year period 56% and three-year period 26%.”

“The Malaysian equity funds have posted "respectable returns" over the mid- to long-term periods, the Federation of Malaysian Unit Trust Managers (FMUTM). It said based on Standard & Poor's report on the fund performance as at July 28, 2006, the average returns for Malaysian equity funds for the seven-year period was 24%, five-year period 56% and three-year period 26%.”

Period (year) 3 5 7

UT Return (%) 26 56 24

UT CAGR (%) 8.01 9.30 3.12

FD Return with 4% CAGR (%) 12.49 21.67 31.59

As we can notice from the table above, by placing your money in unit trust (mutual fund) investment for 3 years, the return for the period would be 26% and when it translates to Compounded Annual Growth Rate (CAGR) which is 8.01. Similarly, for the period of 5 and 7 years, the return is 56% and 24% respectively and for CAGR for both, the former is 9.30% and the later is 3.12%. What will you get if you place your investment in “risk-free” Certificate of Deposit (CD) or known as Fixed Deposit (FD) in English Commonwealth countries? With 4% return annually, the figure will shock us!! For the period of 7 years, this “risk-free” investment performs better than unit trust (mutual fund) investment with more than 7%. When handling your hard-earned monies on hoping for better value creation by those fund managers, it seems that they do not fulfill your hope and as they promise – create value to its investors.

While the promoters of the unit trust investment always brainwash us “look for long term”, “let professionals handle your investment” and so forth, the reality is so cruel – it creates no value at all to the investors for longer term. When the promoters once again claim for the “outstanding” performance for 5 years period, bear in mind that the period is started from the 2001/02 market where it was the lowest. The best fund manager is not who gets the highest return when it is bull market, it is who gets the best result when it is bear market. It reminds me once again a famous quote by Warren Buffett: “It’s when the tide down, only you know who is swimming naked.”

David, is one of the two masterpiece sculptured by Michelangelo from 1501 to 1504. The marble statue is 17 ft height. It originally placed in front of the Palazzo Vecchio, Florence but later on moved to Accademia Gallery, Florence in 1873 to protect it from damage.

David, is one of the two masterpiece sculptured by Michelangelo from 1501 to 1504. The marble statue is 17 ft height. It originally placed in front of the Palazzo Vecchio, Florence but later on moved to Accademia Gallery, Florence in 1873 to protect it from damage.

The statue portrays the Biblical King David before he battles with Goliath. It represents a spirit of Florentine Republic, an independent city state threaten by more powerful rival states. To the citizen of Firenze (Florence), David was a symbol of fortezza and ira, strength and anger. It is a cunning victor over superior enemies. Unlike previous Davids, who shown after victory against Goliath, David by Michelangelo shows his determination and courage to fight against a more superior enemy.

There are two replica of David in Firenze, one in front of the old city hall, and one on a hill overlooking the city.

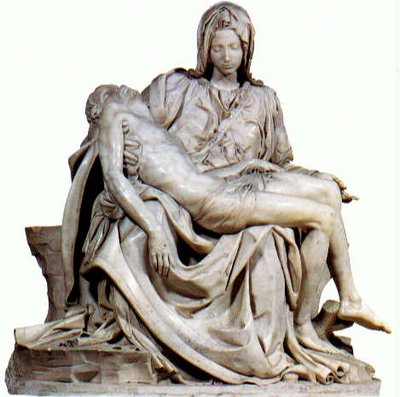

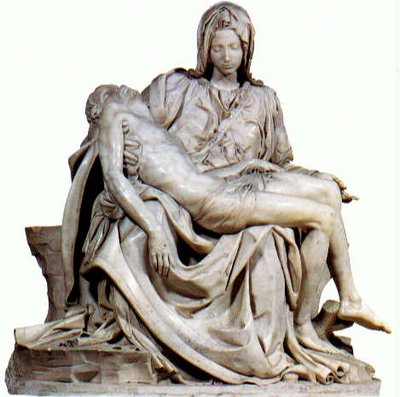

The Pieta, which many regard as the greatest sculpture ever made is located in Saint Peter’s Basilica, Vatican City, Rome. It is created by Michelangelo from 1498 to 1500. The marble sculpture was finished before he turned to 25. The art marble depicts the body of Jesus in the arms of his mother Mary after the Crucifixion.

The Pieta, which many regard as the greatest sculpture ever made is located in Saint Peter’s Basilica, Vatican City, Rome. It is created by Michelangelo from 1498 to 1500. The marble sculpture was finished before he turned to 25. The art marble depicts the body of Jesus in the arms of his mother Mary after the Crucifixion.

Giorgio Vasari, Italian painter and architect in his “Lives of the Artists” published in 1550, comment: "It would be impossible for any craftsman or sculptor no matter how brilliant ever to surpass the grace or design of this work, or try to cut and polish the marble with the skill that Michelangelo displayed. For the Pieta was a revelation of all the potentialities and force of the art of sculpture. Among the many beautiful features (including the inspired draperies) this is notably demonstrated by the body of Christ itself. It would be impossible to find a body showing greater mastery of art and possessing more beautiful members, or a nude with more detail in the muscles, veins, and nerves stretched over their framework of bones, or a more deathly corpse. The lovely expression of the head, the harmony in the joints and attachments of the arms, legs, and trunk, and the fine tracery of the veins are all so wonderful that it is hard to believe that the hand of an artist could have executed this inspired and admirable work so perfectly and in so short a time. It is certainly a miracle that a formless block of stone could ever have been reduced to a perfection that nature is scarcely able to create in the flesh."

Previous posts on Capital Guaranteed Fund:

Previous posts on Capital Guaranteed Fund:

Capital Guaranteed Fund I

Capital Guaranteed Fund II

Everybody aware of inflation. Due to this animal, $100 we have after a year (FUTURE VALUE) will not allowed you to purchase a same amount product which is quoted in today price (PRESENT VALUE). Giving 5% inflation rate per annum, your $100 of FUTURE VALUE (after a year) will only allowed you buy a product which is quoted today at $86.38 (PRESENT VALUE). Thus, after a 3 years maturity period, RM 300 million of FUTURE VALUE is equivalent to RM 259.15 million of PRESENT VALUE!! With capital guaranteed capped at RM 300 million (FUTURE VALUE) after 3 years, it’s for sure fund could deliver their capital guaranteed even their investment result is poor. They are left with RM 13.21 million (RM 272.36 million – RM 259.15 million) to play around even their investment result delivered no result at all for the entire 3 years period! That’s a “SURE CAPITAL GUARANTEED, ZERO RISK” Investment!!

The calculation above is simplified to an illustration purpose. The assumption made is there is no return (0%) for entire 3 years period. When fund tagged with “Capital Guaranteed”, it should at least preserve its fund holders’ value. This means that for RM 300 million (PRESENT VALUE), it should at least appreciate to RM 347.29 million (FUTURE VALUE) to align with its tag of “Capital Guaranteed”. If RM 300 million (PRESENT VALUE) remain as RM 300 million (FUTURE VALUE), it actually deteriorates its fund holders’ value at the rate of 5% per annum! What’s the point for investors to invest into these funds if it serves no purpose at all. After all, they could place their money into bank’s Certificate of Deposit (CD) or Fixed Deposit (FD) to enjoy “Capital Guaranteed, Zero Risk” return. Currently, a FD depositor in Malaysia enjoys 3.7% return per annum. So, with RM 300 million (PRESENT VALUE), his account balance will show RM 334.55 million (FUTURE VALUE) after 3 years. That’s almost 35% difference!

When fund tagged with “Capital Guaranteed”, it should at least preserve its fund holders’ value. This means that for RM 300 million (PRESENT VALUE), it should at least appreciate to RM 347.29 million (FUTURE VALUE) to align with its tag of “Capital Guaranteed”. If RM 300 million (PRESENT VALUE) remain as RM 300 million (FUTURE VALUE), it actually deteriorates its fund holders’ value at the rate of 5% per annum! What’s the point for investors to invest into these funds if it serves no purpose at all. After all, they could place their money into bank’s Certificate of Deposit (CD) or Fixed Deposit (FD) to enjoy “Capital Guaranteed, Zero Risk” return. Currently, a FD depositor in Malaysia enjoys 3.7% return per annum. So, with RM 300 million (PRESENT VALUE), his account balance will show RM 334.55 million (FUTURE VALUE) after 3 years. That’s almost 35% difference!

As you notice, the difference of BP-BP and ROI decreases when the investment period is longer. From the table, you will shock to notice that you actually incur loss of 5.28% if you cash out after a year of investment. That means if you invest $ 10,000 at the beginning and cash out after a year, you only manage to get back $ 9,472!!

As you notice, the difference of BP-BP and ROI decreases when the investment period is longer. From the table, you will shock to notice that you actually incur loss of 5.28% if you cash out after a year of investment. That means if you invest $ 10,000 at the beginning and cash out after a year, you only manage to get back $ 9,472!!

How about the return for Certificate of Deposit (CD) or known as Fixed Deposit (FD) in some countries? Assuming CD/FD could give you 4% return per annum, the return over 5 years period would be:

Year 4% return per annum ROI (%)

0 1 0

1 1.04 4

2 1.0816 8.16

3 1.1249 12.49

4 1.1699 16.99

5 1.2167 21.67

When you compare ROI of Fund KSA and CD/FD, you will notice that ROI of Fund KSA only outpaces CD/FD after 4th year!! Amazing, isn’t it? When you pay hoping for get the better return as compared to “risk-free” CD/FD investment, the outcome is shocking. That is no wonder, the promoters always ask you to invest for long term – the longer the better. We do agree that investment should always for long term (more than 7 years). But, this only applies to the investment that creates value to its investors. If you choose a lousy investment, the longer you hold, the worse you get. Time is unemotional, it would not sympathize you because you choose a lousy investment. In fact, time would punish you if you choose a lousy investment. Time only reward to those who choose a good investment, this is the core of the value investment.

Next time, when the promoters of Mutual Fund (Unit Trust) try to persuade you to purchase the fund and show you how good the return, you should ask them one question: the return is on whose perspective, Fund or investor, that’s you who pull out the money to feed them.