There are too many con men out of field waiting for the innocent yet naïve people, to suck out their hard-earned money. No matter it is in the stock market, real estate, commodities market and so forth.

History always tells us something. People who deny history would eventually lose out all. In 1999, when the euphoria of the stock came to the climax, two men, James Glassman and Kevin Hassett wrote a book titled “Dow 36000”. They predicted that Dow Jones Industrial Index will reach at 36000 anytime soon and latest in year 2005. If you think this two gentlemen are an ordinary man, you are totally wrong. Glassman, an investing columnist for the Washington Post, and Hassett, a scholar at the American Enterprise Institute who used to be an economist at the Federal Reserve. Because of their background and title, many people fall into the prey that “they are intelligent people, what they say makes sense”. So, they pour their money into the stock market when the market was at its peak. The result, they lost US$8 trillion (YES! It’s US$8,000,000,000,000 !!!) With this amount, you can buy 3,200 Petronas Twin Tower in Kuala Lumpur, Malaysia. (used to be the world’s tallest building in the world)

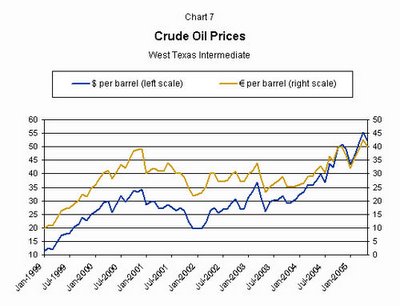

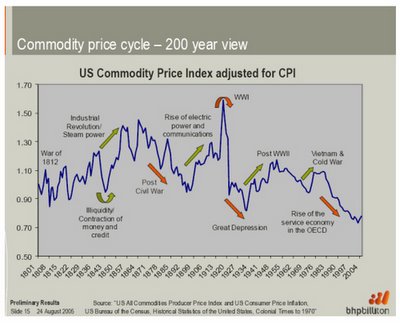

Stepping into the beginning of 21st century, similar phenomenon will appear. From time to time, someone will come out and shout to you:” Oil will reach to $300 per barrel!”, “Gold will hit $3000 per ounce!”. When the euphoria shift to commodities market, you will notice that some magazines will announce “The Death of Equities” and someone will author the book titled “Dows 360”. When this moment arrives, grab as many as you can from the stock market. Of course, choose only “good” stock.

What is a bubble? You won't know about it until it's already happened...and then it's too late,,,