Whenever someone makes an investment, being it in equities, mutual fund (unit trust), real estate and so forth, his objective is to maximize his Return On Investment (ROI). In Mutual Fund, a conventional belief of its return is around 12% per annum. An outcome of the investment return will varied depends on different strategies employed by the investors. Bear in mind that in mutual fund investment, there are 2 typical charges, ie: Sales Load which hover around 5 to 6.5% and Annual Management Fee at 1.5%. Whenever we look at the table of the mutual fund, there would be 3 columns, which are Offer Price (OP), Bid Price (BP) and Net Asset Value (NAV). The difference between OP and BP constitute Sales Load. To make a picture clearer, let’s show you an example.

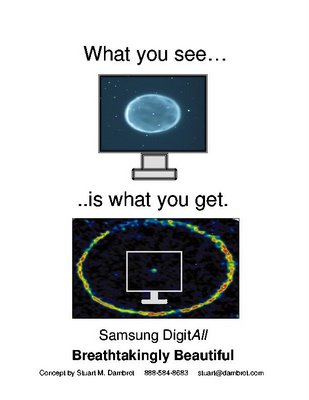

John invested $ 10,000 in Fund KSA on 2nd January 2006 at OP of $1. With this, he will have 9,350 units of the fund (Note: 6.5% Sales Load). After a year, Fund KSA OP is at $ 1.20. At a glance, it shows a return of 20% per annum. Quite impressive with this return rate. If he sold all of his 9,350 units, he will get $ 10,333 (9,350 * $ 1.10517). Instead of the 20% return, he only manages to get the return rate of 3.33% of his original investment. Playing magic, huh? Sometimes, what you see is NOT what you get….

3 comments:

hello friend,

interesting. looking at the 9,350 * $ 1.10517. i just need to confirm how you get the 1.10517 (originally 120%, right?) Thanks

hello friend, can u please tell me why it is 9,350 * $ 1.10517 instead of 9350 x 1.2? 20% profit over the year, thanks.

Hi ccdev,

i try to reply your mail but can't. So, i would explain here:

When you look at the table shown in "What You See Is What You Get? II", BP for Year 0 until 5 as follow:

0.935, 1.0131, 1.0977, 1.1893, 1.2886 and 1.3962. How do i get this figures?

First, 0.935: it derives from 1-0.065, where sales load is 6.5%.

Second, 1.0131: it derives from ((0.935*1.1))-((0.935*1.1)*(0.015)), where we assume 10% annual compounded return and 1.5% annual management fee.

The following figures year after year is just follow a formula of the above. You could get it using Excel.

Remember to go through all 3 series of this post and you will get clearer picture.

Any more questions just let me know.

Post a Comment