1) It’s a good medium to tighten the relationships of our relatives and friends by purchasing the fund from them.

1) It’s a good medium to tighten the relationships of our relatives and friends by purchasing the fund from them.By purchasing from them, they get the commission from the sale. We are taught to be helpful and should try to please everybody, so we can become a friendly people and it’s possible to become an American Idol – a contest based on popularity.

2) It’s a good source to diversify. By not putting all the eggs in a basket, it could ensure our investment would not evaporate.

Hmmmm……..isn’t a mantra from the financial “expert”? By listening to the “professionals”, it wouldn’t go wrong.

3) It’s a good medium to entrust our money to the professionals.

I am so busy with my daily life: my work, my family…etc. I have no time to deal with such investment. By invest in mutual funds, I let the professionals to manage my money and I am sure that their performance is better than mine, if I choose to do so.

4) It’s proven that by invest in it for long term, it could outpace the return rate of putting money in the bank.

The salesman, financial adviser, chartered financial consultant always remind me about this.

5) It’s a good medium to assure that we are social animal – we follow what others do, we are not weird and not unfriendly.

Hmmm……it wouldn’t go wrong where the others head on, right?

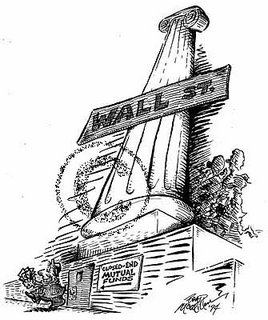

6) It’s a good medium to feed those interested parties such as investment bankers, mutual fund managers, brokerage houses…etc. After all, if not doing so, the unemployment rate might be higher and cause social problems.

Since the unemployment rate become higher and higher, isn’t it good for me to take care of these people, so they wouldn’t create social problems?

7) Mutual fund is approved by government, backed with well established financial institutions and managed by those professionals with the titles like “Financial Adviser”, “Chartered Financial Consultant”…etc. It wouldn’t go wrong since the titles so glamour.

8) It’s a good medium to support the people we admire by purchasing more, so can send him to a hall of fame of “Million Dollar Round Table” (MDRT).

9) The Magic Formula of the fund managing industry: 100 – your age = the percentage of your money that could be invest in equities.

Wow! Do not know since when and where this Magic Formula been created? Whether it falls from the sky, or the Formula been discovered from the Great Pyramid of Egypt. After all, those sophisticated pyramids could be built because of the intelligence of the Egyptian based on the formula. If this formula followed, Warren Buffett should only invest 24% of his net worth in equities since he is 76 years old now. By following this formula, maybe Warren is no longer the 2nd richest person in the world after Bill Gates.

No comments:

Post a Comment