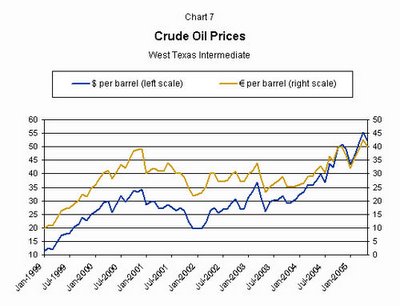

“The price of petrol increase again!” That’s the headline of the news today. While the hike would not be the last one, be prepared for the more economic driven environment.

“The price of petrol increase again!” That’s the headline of the news today. While the hike would not be the last one, be prepared for the more economic driven environment.People are pampered for too long. They expect the government would protect their interest and keep the price lower. This might happen in the utopian world but for sure it would not occur in the reality. Once a while, government might take some measures to control the price of certain products, such as sugar, petrol, poultry products…etc. Where the government is based on the votes from the people, they have much incentives to do so. For the sake of “Protecting People Interest”, the price of these products keep lower than the Real market price. The tricks? Government might use money from the taxpayers to subsidy the difference of the price or request the supplier to sell the products below the market price by implementing the controlled price regime. This might work well for short term, but it could not be last long. The example? Look at the case where the ex-communism blog countries such as Soviet Union, Poland, Hungary and so forth where the price of the products were kept ultra low, but there is nothing on the shelves.

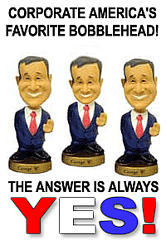

Capital flows where it is respected. If the pricing of the products or services out of pace of the market, capital will outflow from it. Do you think Asian Financial Crisis in 1997/98 is caused by the speculators such as George Soros? Yes, it is, but as a result, not a cause. The cause of the crisis is because people do not respect capital. With the easy credit, people spend the money like there is no tomorrow. Projects after projects started not for the economic consideration but for the title of “The Biggest”, “The Longest”…etc. With a leader who stressed Form Over Substance, the only outcome is a Massive Wealth Transform from the average Joe on the street to the interested parties connected to the leader. The most pitiful part is the average Joe, though suffered from the mismanagement of their leader, still praising the leader as a “Father of Development”.

Capital flows where it is respected. If the pricing of the products or services out of pace of the market, capital will outflow from it. Do you think Asian Financial Crisis in 1997/98 is caused by the speculators such as George Soros? Yes, it is, but as a result, not a cause. The cause of the crisis is because people do not respect capital. With the easy credit, people spend the money like there is no tomorrow. Projects after projects started not for the economic consideration but for the title of “The Biggest”, “The Longest”…etc. With a leader who stressed Form Over Substance, the only outcome is a Massive Wealth Transform from the average Joe on the street to the interested parties connected to the leader. The most pitiful part is the average Joe, though suffered from the mismanagement of their leader, still praising the leader as a “Father of Development”.